With the introduction of ‘auto-enrolment’, more and more people are saving towards a pension. Most people get a government top up on their pension savings in the form of tax relief on their contributions – but not all.

The way it is given differs depending on what kind of pension scheme you are in or whether you are in a salary sacrifice arrangement. Here we explain how it works for employees.

What are the benefits?

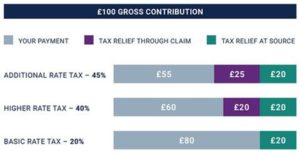

One of the benefits of saving into a pension is the government boosts your contributions, through tax relief. The amount of tax relief is calculated based on your highest marginal percentage rate of income tax.

The tax relief you can receive depends on your income tax rate.

This means that if you are a basic rate tax payer, you will receive an extra 20% on your eligible contributions.

If you are a higher rate taxpayer its 40% and it’s 45% if you are an additional rate tax payer. The rates are slightly different in Scotland, due to alternate tax bands.

How does pension tax relief work?

The way pension tax relief works differs depending on what kind of pension scheme you are in:

- If you are in a ‘relief at source’ arrangement, the pension contribution is deducted after tax is calculated and HM Revenue & Customs (HMRC) later send the value of the tax relief to the pension scheme.

- If you are in a ‘net pay’ arrangement, the pension contribution is deducted before tax is calculated on your pay (meaning you receive tax relief there and then).

Relief at source

Relief at source arrangements are used by personal and stakeholder pensions (that is, pensions set up with an insurance company) and some auto-enrolment workplace pensions.

Here, 20% is added ‘at source’, which means it is done automatically for you when you pay into your pension. If you are a higher or additional rate taxpayer you will still receive 20% at source but, you will be able to reclaim the additional tax relief back through your tax return.

So, in the right-hand example if you are a basic rate taxpayer and wanted to make a gross contribution of £100 you would pay £80 and receive £20 tax relief at source. For higher rate taxpayers, you still pay £80 and receive £20 tax relief at source. However, you then claim the further £20 through your tax return, so that the net cost is effectively £60.

If you are a 20% taxpayer, there is no further adjustment that needs to be made. However, under this system, higher and additional-rate taxpayers must make a claim to receive the extra relief due to them.

Net pay arrangements

Net pay arrangements are used by many traditional occupational (‘works’) pensions. Some workplace pensions set up under the recent auto-enrolment programme do not require you to do anything to get your tax relief.

Your pension contributions are deducted from your salary by your employer before income tax is calculated on it. Therefore you get relief on the amount immediately at your highest rate of tax.

What is salary sacrifice?

Many employers offer to run their employees’ pension schemes in conjunction with a salary sacrifice arrangement. They do this because it saves both you and them National Insurance contributions (NIC).

To explain: an employee’s pension contributions usually attract tax relief (provided they are a taxpayer) but they do not ordinarily attract NIC relief. This means that an individual pays income tax on the amount after pension contributions have been deducted, but pays NIC on the amount before the pension contributions have been deducted. However, if an employer makes a contribution to an employee’s pension scheme, then there is no tax or NIC to pay on the value of the contribution.

Under a pensions salary sacrifice arrangement, you agree to give up part of your salary in return for your employer making a larger contribution to your pension pot. This can save you money because the NIC you would be due to pay are calculated on the smaller salary. Your employer would pay any employer’s NIC on the smaller salary too. You may also benefit from more pension contributions from your employer, if they are willing to contribute some of the money they are saving on employer’s NIC.

A salary sacrifice arrangement involves altering your employment contract to give up a portion of your earnings. This may affect future calculations of pensions, redundancy pay, statutory maternity pay, paternity pay, shared parental pay, etc. You should make sure you are clear on these employment law aspects before deciding to enter into a salary sacrifice arrangement so you fully understand how they may affect you in the future.

You should also be aware that a salary sacrifice arrangement is not allowed to reduce your cash pay below the relevant national minimum wage or national living wage rates. This rule is in place because of fears that people on lower incomes may sacrifice their salary to an amount below the Lower Earnings Limit, that is, the limit at which you start to accrue entitlements under the social security system. Your employer should be keeping an eye on this, but there is no harm you doing so too.

If you are paid slightly more than the minimum wage, it is important to watch out for any changes to the minimum wage rates. This is because a rise in the minimum wage rate could affect your ability to enter into, or remain in, a salary sacrifice scheme.

Pension tax relief for low earners: what problems might arise?

If you are a low earner (that is, if you earn below or only just above the personal allowance – £12,570 in 2021/22), you may wish to check which type of pension scheme you are in. If you are in a relief at source arrangement, the pension provider claims 20p tax relief back from HMRC for every 80p of your contribution received – no matter what the level of your earnings.

If, however, you are in a net pay arrangement, you will not get any tax relief. Many people think this is unfair and there are growing calls for the government to change the rules.

How do I get my pension tax relief?

You’ll automatically get the 20% basic rate tax relief if:

- If you’re part of a workplace pension where your pension contributions are deducted from your pay before income tax – this means that you get the tax relief there and then. This is known as a ‘net pay’ arrangement.

- If your pension provider claims the 20% tax relief on your behalf and adds it to your pension pot. This is known as a ‘relief-at-source’ arrangement. All personal pensions, and some workplace pensions, are relief-at-source pension.

How do I claim additional pension tax relief?

If you are a higher rate, or additional rate tax payer, then you will be able to reclaim your further tax relief on your pension contributions through your annual tax return.

Please feel free to give us a call on 0208 249 6007 if you need to discuss this further.

Written by Irina Stucere.