Did you know the UK rate of inflation rose to 5.4% in December 2021? This is the highest rate of inflation since March 1992, when it stood at 7.1%.

The Office for National Statistics (ONS) has said that the rate for Consumer Price Index (CPI) shot up from 5.1% in November. This is the fifth month in a row it has risen.

Here is what you need to know about inflation and how the increase could affect you.

What is inflation?

Inflation is a measure of how much the cost of living increases over time. It is one of the most relevant economic measures for consumers as it affects their buying power and has an impact on everything from fuel prices to mortgages, as well as things like the price of train tickets and the cost of shopping.

People usually measure inflation by comparing the cost of things today with a year ago. This average increase in prices is known as the inflation rate.

When the cost of basic goods and services is up, as is the case now, households get less for their money which means the value of the pound has depreciated. If the rate of inflation is 1%, it means that prices are higher by 1% on average. For example, a loaf of bread that cost you £1 a year ago will now cost you £1.01.

How is inflation measured?

In the UK, inflation is measured by the ONS which produces three main estimates of inflation: the CPI, the Consumer Price Index Including Housing Costs (CPIH) and the Retail Price Index (RPI).

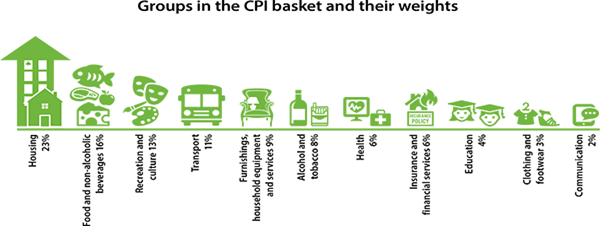

To calculate the CPI – the most commonly used figure – the ONS looks at the prices of thousands of goods and services across the UK and compares the figures year-on-year.

The items used in the basket to compile the various measures of price inflation are reviewed each year. For example, in 2019 smart speakers were added to the list of items monitored to ensure the UK’s measure of the cost of living reflects the public’s spending habits.

Why is it increasing?

Inflation is a variable which can go down as well as up.

During the 2020 lockdowns brought on by the Covid pandemic, inflation was low as people couldn’t get out and spend their money.

But as society began to open up again and businesses opened doors once more there was, and continues to be, a pent-up demand for goods and services.

This demand coupled with a consistent, or in some instances a reduction of, supply has incentivised businesses to shift prices up hence stimulating the economy.

A growing economy has increased employment rates, pumping more money into circulation and in turn demonstrating a healthy economy as financial markets recover from Covid restrictions. Price rises in food and non-alcoholic drinks pushed up inflation last month, the ONS said, while costs also rose for restaurants and hotels, furniture, household goods, clothing, and footwear.

The Bank of England has predicted inflation will hit 6 per cent in April.

Interest and inflation conflation

There is often a correlation between interest and inflation rates.

One is used to alter the other depending on the current state of the economy and outside factors, such as a global pandemic.

Where inflation rates are used to measure the cost of living, the interest rate is the amount charged by the lender to the borrower.

Low interest rates mean it’s essentially cheaper to borrow money from lenders, with the BoE cutting interest rates to an all-time low of 0.1% in March 2020.

This extreme action was brought on by the Covid pandemic and, while the rate has been increased to 0.25% last month, there are increasing calls for the BoE to further increase interest rates.

The low interest rate was implemented to encourage people to spend money during lockdowns and restrictions brought on by the Covid pandemic, rather than save or keep it in savings.

Generally, lower interest rates mean people spend more money, leading to economic growth with higher prices and higher employment rates as businesses keep up with demand.

This can also work the other way around when there is an ‘overheating economy’.

High interest rates make it more appealing to save money, leading to a slower economic growth by dropping prices of goods and services, which can lead to higher unemployment rates.

What does it mean for me?

A little inflation can be good for the economy as it can encourage shoppers to buy sooner. When prices are going up, consumers will want to buy now rather than pay more later, which increases demand in the short term and can boost productivity.

The way inflation affects your own finances, however, depends on your individual circumstances.

Rising inflation means shrinking pay packets. UK wage growth already lagged inflation in November, with real average weekly earnings falling during the month for the first time since July 2020.

Average total pay, including bonuses, grew by 4.2% in the quarter to November, while basic pay without bonuses was up 3.8%. Average total pay growth for the private sector was 4.5% in September to November, while it was 2.6% for the public sector.

A high inflation rate means shoppers can buy less for the same amount of money. This means they may have to spend more on food, energy bills and filling up their car.

It is also bad for savers, as historically low interest rates combined with rising inflation means they have less chance to see any real return on their money.

For the average consumer or household inflation means, loan rates are adjusted higher, a decrease in the length of interest-free periods on credit cards for balance transfers and for purchases, whilst access criteria to mortgages could be tightened in the course of the next year.

This particular rise in inflation comes after separate data published on Tuesday showed that wage rises for UK workers were already failing to keep up with the cost of living.

While many households are already feeling the squeeze, cost of living increases are expected to bite hardest in spring when the energy price cap rises again.

Millions of workers will also have to pay hundreds of pounds extra a year when National Insurance contributions increase by 1.2 per cent in April.

Written by Drew Callingham.