As of 6th July 2022, the Class 1 NIC threshold for employees will have parity with the income tax threshold, also known as the personal allowance.

The important change to the National Insurance contributions (NIC) threshold was announced by Chancellor Rishi Sunak, as part of his Spring Statement in March.

The move is designed to lessen the impact of the 1.25 percentage point rise in employee NICs from 12% to 13.25% on earnings up to £50,270 per annum. Earnings above this figure now incur NICs of 3.25% instead of 2%. In fact, the revised NIC threshold in July will remove NICs altogether for some 2.2 million workers nationwide.

At the time of writing, employee income is not subject to employee NICs until they earn £9,880 per annum. This threshold will rise to £12,570, in line with the personal allowance, as of 6th July 2022.

Helen Thornley, technical officer, the Association of Taxation Technicians (ATT), said those earning less than £34,272 per annum will benefit most from the uplifted NIC threshold. The uplift will essentially cancel out the rate rise for most. “The threshold rise in July is worth more than April’s increased rate in national insurance,” said Thornley.

Directors in limited companies pay NICs in a different way to employees on what is known as an annual basis. This means NICs are calculated using their annual earnings rather than from what they earn in each pay period. For 2022-23, a director will be able to earn £11,908 before paying Class 1 NICs. The annual figure differs to employees because this accounts for 13 weeks of £9,880 and 39 weeks of £12,570.

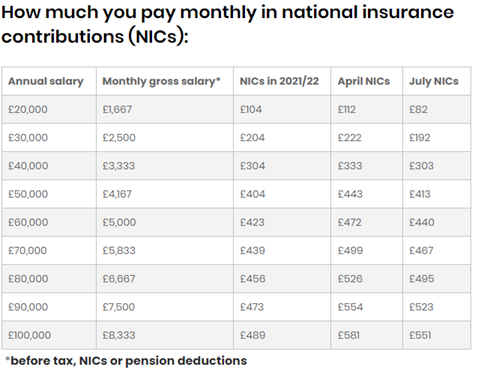

The above table illustrates the effect of NI for everyone. So, it is quite important to reassess the structure to get the most benefit.

Limited company directors need to assess few factors before making decisions. If a director increases their salary to £11,908 per year, they may choose to reduce their dividends by the same amount as the increase, so their personal income tax position will most likely be unchanged. However, the increased salary (and any employer’s National Insurance) will be able to be offset against the company profits for corporation tax purposes.

Paying a salary of £11,908 rather than a salary of £9,100 will give a corporation tax saving of £533.52 while the tax deduction for the National Insurance will give a further corporation tax saving of £80.29. Overall, the company tax bill will be reduced by £613.91.

In most cases there is likely to be a small saving by increasing salary and reducing dividends for directors so that they take a total salary for the current tax year of £11,908. Based on the figures above, the overall saving will be £191. While this is not a trivial amount the question becomes whether the additional admin overhead of making the change outweighs any cash benefit that is obtained.

In a small number of cases, it may be possible for the employment allowance to be claimed to offset the extra employer’s National Insurance mentioned above. In these cases, the savings become more worthwhile, but care must be taken to ensure the conditions for claiming the employment allowance are met.

If you would like to discuss the alternatives available to you as a result of the National Insurance changes then please get in touch with our team today to find out more.