Two years on from the start of the Covid-19 pandemic, just as we saw some light end at the of the tunnel the world is now facing a major geopolitical uncertainty. It is safe to say that small and medium-sized enterprises, or SMEs, are facing a range of pronounced business challenges. Some new, some all too familiar. While many forums list and discuss these challenges, there are very few blogs around what business owners can do to manage and overcome these challenges. This article focuses on some of the techniques that will help business owners. The good news is, despite these challenges, 64% of UK managers and decision-makers in a global survey, said they felt optimistic about their organisation’s future in 2022/2023.

Rising Energy Prices & Soaring inflation

Rising energy tops the list of biggest challenges faced by businesses. The problem of rising energy costs coincides with many business’ energy contracts coming to an end in line with the financial year in April. The Federation of Small Businesses recently revealed that annual electricity and gas bills for small businesses in London rose by 145% and 258% respectively between February 2021 and February 2022.

Simple techniques that we use at home to save costs could be used. For example, switching off computers and other equipment overnight if they aren’t being used; using energy efficient light bulbs; making sure your premises are insulated against drafts; and only using as much hot water as you need.

Another thing that could be done is speaking to an energy broker. Regardless of the size of your energy bill, it might be worth going to a broker to see what they can do: they buy energy in bulk from the major suppliers so they will always be able to offer a better deal. I would also recommend using online comparing tools to get the best value deal. Remember, energy cost is now a significant portion of your costs so it’s worth spending the time.

Cashflow

With rising costs and credit terms being squeezed, cashflow will be the next challenge business owners will face. Moreover, this survey suggests of SMEs that are owed money, 78% are having to wait at least one month after their agreement terms before finally being paid.

Here are some techniques to be on top of your cashflow:

- If you haven’t already try making sure your books are up to date. By looking at real time information you will be in a much better position to plan cashflow. Cloud based accounting packages that links to your bank can give you real time cash position and forecast that can help you manage. Speak to us today if you are keen on getting set up with one of these cost-effective systems.

- Be sincere and speak to your creditors. They are a business too and understand how it is to have cashflow challenges. Its better to let them know in advance, rather than being chased.

- Reviewing your client billing, see if you could move annual clients to quarterly or monthly billing, offer discounts or even additional services for early payments.

- Consider cashflow financing. Invoicing financing is a good alternative to traditional lending, as it’s based on your client’s creditability so the chance of being approved will be higher.

- Call your suppliers and ask for a discount. After all, every penny helps.

Recruitment & retaining good talent

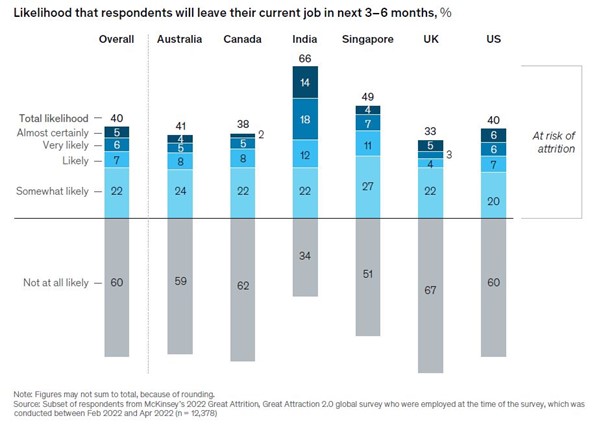

The Great Resignation continues in 2022 on throughout UK businesses and will most likely strike your business. However, the hope is that you can use this to recruit fabulous new people while focusing on retaining your top talent at the same time. It is estimated that the UK lost around 1 million of its workforces during Covid due to retirement, change in life priorities and migration. Business owners are therefore struggling with retaining good staff. According to Mckensey’s latest research 40% of workers globally say that they might leave their jobs soon.

Here are some pointers on how to overcome this challenge:

- Looking at hiring for Potential and not experience

- Do an Exit interview by asking all the difficult questions that you would never get answers to. This will let you understand the role, why the person is leaving and what sort of person you should be looking for.

- A clear job advert to showcase the benefits of working for you that are not just financial such as, company culture, nonfinancial benefits, and team events.

- Look over at the package. The cost of rehire is a loss as losing an employee will be mots of a £1k annual salary gap between you and a good candidate.

- Look at what your competitors are offering and try searching candidates on LinkedIn

- Consider flexible working wherever possible.

- Speak to your employees and see what you can do to improve retention

Rising Interest Rates

Interest rate dropped to its lowest level during the COVID pandemic. With inflation now reaching at the highest levels, analysts at Capital Economics think the Bank will ultimately have to lift rates to 3% to quash inflation. But other economists think they won’t have to go so high such as, Pantheon Macroeconomics who reckon interest rates will peak at 1.75%. The Bank of England hopes to slow the rate at which prices are increasing. It has warned that inflation could pass 11% later this year.

Interest rate increases can affect a business directly and indirectly. Where the business has lending on flexible rates, the monthly cost of serving these borrowings will also increase as rates rise. where loans are fixed terms, you will need to allow for the increased cost if they revert to flexible terms after a fixed period. This applies to all types of borrowing the business has. Similarly, interest rates can impact business investments and savings. Business needs to be mindful in planning for long term investment strategies that align with the projected rate increases.

Here are some solutions to managing your interest costs:

- Where possible, agree on fixed rates as its most likely that interest rates would go upwards only for the next decade.

- Evaluate the possibility of paying back borrowings if savings/ investments are not yielding more than your interest cost

- Look at re-financing options for properties

- Reduce your risk as rising interest rates mean that more conservative instruments will begin paying higher rates as well. Furthermore, the prices of high-yield offerings (such as junk bonds) will tend to drop more sharply than those of government or municipal issues when rates increase.

- Go short on Bonds. To the extent you already own bonds, the prices on your bonds will fall in a rising rate environment. But if you’re in the market to buy bonds you will benefit from that trend, especially if they are short-term bonds, since prices have fallen more than usual relative to long-term bonds. Normally, they move lower in tandem

At outsourced we offer our clients proactive hands-on planning, so they can overcome challenges and make them into great opportunities to grow the business. Give us a ring today if you think you are not getting value for money from your Accountant.