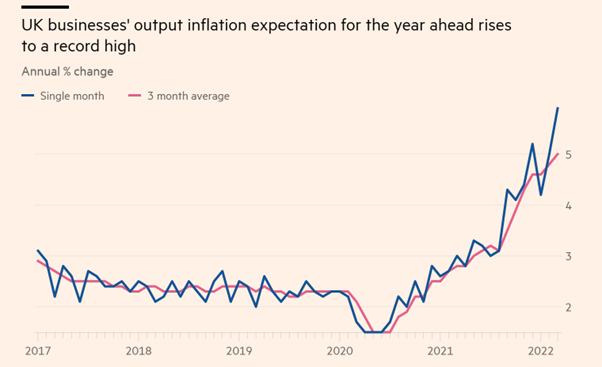

The majority of the UK businesses expect the Russian invasion of Ukraine to result in lower sales and a growing proportion say rising energy and input prices are prompting them to curb their investment plans, according to official data published on Thursday. Of the nearly 3,000 companies interviewed for a Bank of England survey in March, 48 per cent said they expected the Russia-Ukraine war to hinder their year-ahead performance, with an average impact of 3 per cent lower sales. More than one in four businesses are also worried about rising input costs and a similar proportion is concerned about higher energy prices, sharply up from February, March data published by the Office for National Statistics showed on Thursday.

The report found that 37 per cent of small business owners admitted to being unable to pass any rising costs onto customers, forcing them to cut their own costs to keep prices static. Just one per cent said they were able to pass on costs in full.

Again, 37 per cent of survey respondents said that they felt that the constant high cost of doing business was a greater detriment to their cash flow than late payment or unexpected price rises.

Firms are still facing an uphill battle to make ends meet despite positive signs of an economic recovery,” said Ian Cass, the Forums managing director.

This would cause a significant effect on the businesses especially when they are about to get a third wave of hit. Businesses are still struggling to recover from Brexit and covid impact and on top of it with the third wave of hit due to inflation, will take many companies out of businesses.

This will negatively impact in everyone’s life as the unemployment would rise significantly. Businesses must come up with a solution in order to survive. One of the possible way is diverse their portfolio and use efficient economics of scale.

Another way is by preparing a robust control of the finances. Budgeting and factoring is one way to manage the cash flow for the businesses. Budgeting is the basis for all business success. It helps with both planning and control of the finances of the business. If there is no control over spending, planning is futile and if there is no planning there are no business objectives to achieve.

A budget is a plan to:

- control the finances of the business

- ensure that the business can fund its current commitments

- enable the business to meet it objectives and make confident financial decisions; and

- make sure that the business has money for future projects.

If you’re running your business without a proper budget you may find you’re actually just running around in circles and not meeting your long-term goals. By taking the time now to set a budget, you will free up time in the future and give yourself the best chance of achieving the rewards you want for your hard work. Here at Outsourced Acc we provide with all the necessary tools for the business and assist them with the financial planning. Let us know if you need such tools which can not only assist you with usual reporting to HMRC but also help you with sustainability when the economy is so unpredictable.