Need some clarity on National Minimum Wage and How it Applies to You…read on!

The National Minimum Wage (NMW) was introduced on the 1 April 1999 for workers aged 18 and over. It was extended to workers who are 16 or 17 years old (with apprentices excepted) and legally allowed to leave school on the 1 October 2004. An apprentice minimum wage rate was introduced for the first time in respect of pay reference periods starting on or after the 1 October 2010.

The National Living Wage (NLW) was introduced from the 6 April 2016 for all workers aged 25 and over. It is effectively just a further category of NMW and all rules regarding its calculation and payment are identical to those of the NMW. Note that the NLW is different from the Living Wage which is set independently by the Living Wage Foundation and is calculated according to the basic cost of living in the UK. Some employers choose to pay the Living Wage on a voluntary basis.

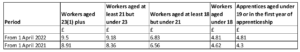

There are now five rates for the NMW/NLW, these are known as the NLW (25 years old and over), workers aged 21 plus, workers aged at least 18 but under 21, workers aged under 18, and apprentices aged under 19 or in their first year of their apprenticeship).

From 6 April 2015, the National Minimum Wage Regulations 2015 (SI 2015/621) consolidated the original regulations, the National Minimum Wage Regulations 1999 (SI 1999/584) and subsequent amending regulations with the aim of making the rules clearer and more workable for employers and employees.

A NMW and NLW calculator enables a user to verify if the correct NMW or NLW is being paid and where necessary, calculate any arrears due to workers following any changes in the NMW or NLW rates – see here. Guidance on calculating the minimum wage to help employers meet NMW legislation is at www.gov.uk/government/publications/calculating-the-minimum-wage .

Exemptions

There are exemptions from the NMW and NLW for:

- the self-employed

- volunteers or voluntary workers

- company directors

- Family members, or people who live in the family home of the employer who undertake household tasks

All other workers including pieceworkers, home workers, agency workers, commission workers, part-time workers and casual workers must receive at least the NMW.

Penalties

If an employer has not paid at least the NMW, HMRC can send a notice of arrears and charge a penalty on the employer. With the introduction of the NLW the penalty for non-payment is 200% of the amount owed, unless the arrears are paid within 14 days then the penalty is reduced by half, to 100%. The maximum fine for non-payment is £20,000 per worker. Employers who fail to pay can be banned from being a company director for up to 15 years.

Recent changes

Following a consultation which ran from the 17 December 2018 until the 31 March 2019, HMRC announced that amended regulations would be introduced in respect of the NMW for salaried workers and subsequently published SI 2020/339 to effect the change.

The main change introduced was the removal of ‘salary premiums’ from the calculation of annual salary and basic hours. Employers were, in some circumstances, also given the option to change a calculation year for salaried workers subject to giving at least three months written notice to affected workers. The amendments also altered the treatment of a worker’s expenditure that is connected to their employment. This will not result in a reduction of the worker’s remuneration for the purpose of calculating the NMW, provided the employer intends to, or already has, reimbursed the worker for that expenditure.

Written by Athmeka Lakshman