Many of us are very new to the term financial sanction. It is very important to understand as it impacts how you do business across different jurisdictions.

With these financial institutions’ operations expanding globally, the repercussions of non-compliance with AML regulations and risk of financial sanctions is greater – hence, their need for continuous assessment of changes in the political and economic environment is crucial.

Impact of non-compliance

Failure to comply with AML laws and regulations and breaches of financial sanctions can have serious consequences: punitive fines, criminal proceedings, damaged reputations and sanctioning – all crystal-clear motivations to justify efforts of compliance. All the consequences listed above can lead to serious damage to a financial institution’s credibility and performance. Becoming a sanctioned party due to breaches of financial sanctions can be even more damaging. Becoming sanctioned by one or more global bodies considerably reduces, if not halts, a financial institution’s ability to provide for and cater to its international customers’ needs for performing global transactions. Notwithstanding that financial sanctioning, which includes the freezing of assets by counterparties, will result in tremendous pressure on the sanctioned financial institution’s liquidity.

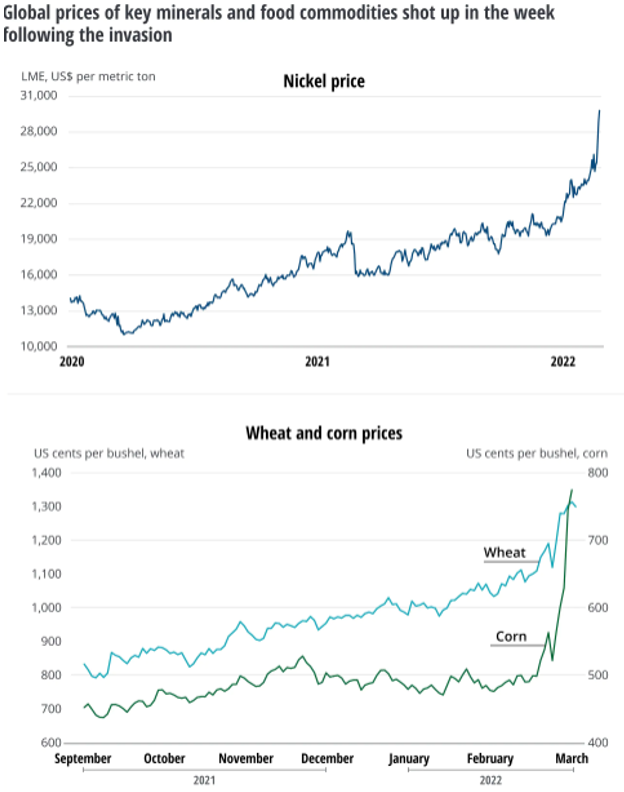

Recently due to the Russia-Ukraine war there has been huge sanction on Russian business operation. This has resulted Russian Ruble to drop by 40 %. In the week following the start of the war, the global prices of oil and natural gas rose sharply, especially gas in Europe. In addition, the prices of key mineral and food commodities increased, including nickel, palladium, neon, wheat, and corn (figure 4). To some extent, these increases reflected fear and risk rather than actual sanctioning or disruption of trade. Investors likely worry that there could be new events that would disrupt trade in commodities, including European reductions in purchases of Russian oil and/or gas, or possibly a Russian decision to limit or curtail exports of key commodities.

Higher global commodity prices, if sustained or exacerbated, will likely cause accelerated and prolonged high inflation in many countries, especially in Europe. Higher commodity prices can also weaken economic growth. Prior to the invasion, some of the world’s leading central banks were already on a course toward tighter monetary policy, a reaction to the sharp increase in inflation in many countries. While the war could exacerbate inflation, it could also weaken growth. Thus, central banks will have to choose which of the two scenarios is more important. Futures markets indicate that many investors expect a continued tightening of monetary policy but at a slightly slower pace. Based on those interest rates, investors evidently think that the crisis will have a negative impact on economic growth in the West, thereby implying less inflationary pressure. On the other hand, higher energy prices and more disruption to supply chains would imply higher inflation. Thus, for central banks, it will be a challenging balancing act.

This war has impacted energy supplies and the supply chain across the whole of Europe as Russia plays a significant part in Europe and rest of the world.

In summary this will affect us significantly. It will also increase the cost of doing business and likely delays important business investment decisions. In the days, weeks, and months to come, the direction of commodity prices and the prices of financial assets will evolve in ways that, hopefully, will enable businesses to make informed decision. It is very important to understand a business’s financial position to determine the profitability. Cash flows and budgeting should play more significant role rather than financial statements. We as consultants can help you to make crucial decisions. We can also support you in order to calculate the break even and the price which you should be charging to the customer. Please contact us if you need support in order to have better understanding of your business.

Written by Kazi Ashraf.