Research and Development (R&D) tax relief supports companies that work on innovative projects in science and technology. You may be able to claim Corporation Tax relief if your project meets the standard definition of R&D.

It’s important to understand clearly which projects will be eligible for claim relief. You must demonstrate the work you have carried out and have scientific or technological advances. An advance in science or technology means an advance in overall knowledge or capability in a field of science or technology (not a company’s own state of knowledge or capability alone). This includes the adaptation of knowledge or capability from another field of science or technology in order to make such an advance where this adaptation was not readily deducible. Although a company may have increased their own knowledge there is no evidence from the information provided of the project advancing overall knowledge or capability in a field of science or technology. The routine analysis, copying or adaptation of an existing process, material, device, product or service will not advance overall knowledge or capability.

Each claim you make must clearly be supported by:

![]() Having looked for an advance in the field.

Having looked for an advance in the field.

![]() Having to overcome the scientific or technological uncertainty.

Having to overcome the scientific or technological uncertainty.

![]() Attempting to overcome the scientific or technological uncertainty.

Attempting to overcome the scientific or technological uncertainty.

![]() Could not have been easily worked out by a professional in the field.

Could not have been easily worked out by a professional in the field.

There are two main types of R&D Claims

It’s important to establish which claim method will be applicable for you as this will define how the claim will be calculated.

Type 1: (SME) R&D tax relief

You can claim SME R&D tax relief if you’re a small and medium-sized enterprise with both of the following:

- less than 500 staff

- a turnover of under 100 million euros or a balance sheet total under 86 million euros

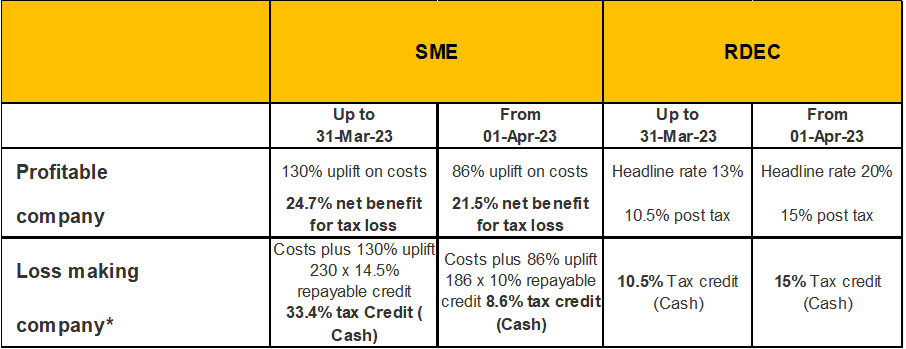

Under SME, your R&D expenditure is enhanced by a % to increase to your cost and then a decrease or loss of enhancement to be provided as a relief, which can be either carried forward as a loss or a tax credit. You will need to include a partner(s) and linked enterprises when you work out if you’re a SME.

Type 2: R&D expenditure credit (RDEC)

Large companies can claim expenditure credit for working on R&D projects. Under this method, you can claim for credit or carry forward loss calculated as a % of total of R&D expenditure during the year.

Upcoming changes in applying for R&D relief

The government has recently announced some fundamental changes to the way and the method of applying and calculating your R&D Relief. We will look at these changes and how this will impact you claiming R&D in the future. These measures will come in to place and will apply to all accounting periods ending after the 1st April 2023.

The objective of these changes is to further incentivise genuine claims, tackling abuse and improving compliance. All claims going forward will have to be filed digitally. Moreover, additional information forms will have to break the costs down across qualifying categories, providing a description of the R&D, endorsed by a named senior officer of the company, details of the agent who has advised and companies will need to inform HMRC in advance ( within 6 months of the end of the period).

In addition, there are changes to the measures above R&D tax relief for SMEs. The SME additional deduction rate will be reduced from 130% to 86%, and the rate of the SME payable credit rate ,which can be claimed for surrender able losses, will be decreased from 14.5% to 10%.

The RDEC is a standalone credit that is brought into account as a taxable receipt in calculating trading profits. The current general rate is set at 13% of qualifying R&D expenditure. This measure increases this rate from 13% to 20%

At outsourced ACC, we ensure our clients get the best advice to ensure they are making accurate claims. If you are keen to find out more about R&D tax relief and if your company would qualify, please give us a ring. Our team of accounting experts would be delighted to assist you.

Please Visit our website for more or contact us on 0208 249 6007 for more information, and we will guide you through the process.