An employee ownership trust, also known as an EOT, is a trust that enables a company to become owned by its employees and can be set up by existing shareholders of a company. It was created by the Finance Act 2014 to encourage more companies to become employee owned. Since then, it’s been an attractive mechanism for owners to exit while ensuring the company continues to operate.

The incentive for owners is that the Government introduced very generous tax breaks to encourage shareholders to move to an employee-ownership model. However, to qualify for the tax incentives, the employee ownership needs to be structured in a particular way. While this is a great way for business owners to exit, it’s also known to benefit employees. Some of the key benefits seen are greater employee engagement and commitment, reduced absenteeism, Greater drive for innovation and Improved business performance.

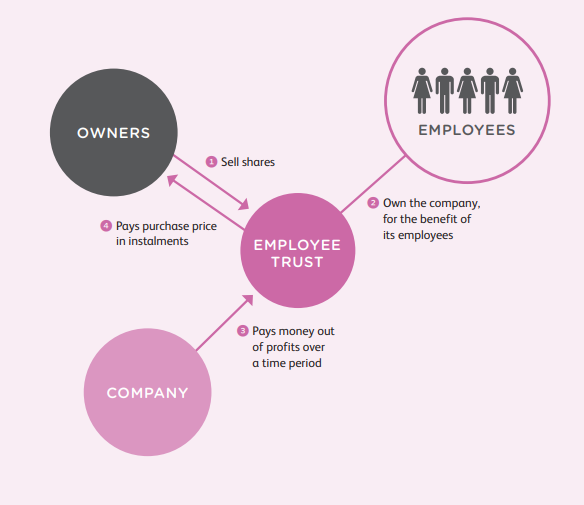

How does it work?

A qualifying EOT will be established with a corporate as the trustee of the EOT (the Trustee Company).

The shareholders sell their shares to the Trustee Company under a share purchase agreement. The shareholders and the Trustee Company will jointly engage a share valuation expert to value the company. The Trustee Company will use this value as the basis for determining the purchase price. On the sale of the shares, the purchase price will create a debt owed by the Trustee Company to the shareholders which will be left outstanding (see diagram).

The company will continue to generate trading profits each year and it will use these profits to make contributions to the EOT. The EOT will use these contributions to repay the outstanding purchase price that it owes to the shareholders.

There is also a possibility of the EOT: obtaining external funding to pay off the shareholder if the exit is time sensitive.

How is the EOT Managed?

As all trusts you will need to appoint trustees to run the EOT. Their role will not be to manage the company but more of a shareholder role to ensure its being led in a way that maximises employee engagement and commitment. An employees’ council is created in most cases.

What are the tax benefits for the owners?

- owners selling their shares may do so free of capital gains tax

- Once a company is owned by an EOT, it can pay annual bonuses to its employees free of income tax

As in any structure and tax benefit you need to make sure all the following conditions are met in order to be eligible:

![]() A formal employee trust much be created, and trustees appointed in accordance with the trust rules. You will need a help of a solicitor to do this for you

A formal employee trust much be created, and trustees appointed in accordance with the trust rules. You will need a help of a solicitor to do this for you

![]() The trust must hold more than 50% of the shares in the company and controlling interest of the company. It must continue to hold the controlling interest at the end of each tax year to benefit from the tax reliefs.

The trust must hold more than 50% of the shares in the company and controlling interest of the company. It must continue to hold the controlling interest at the end of each tax year to benefit from the tax reliefs.

![]() All employees must be beneficiaries to the trust and any benefits received must be in the same terms.

All employees must be beneficiaries to the trust and any benefits received must be in the same terms.

![]() The company transferring the shares must be a trading company, A company formed to hold significant cash, assets or investments may not be considered a trading company

The company transferring the shares must be a trading company, A company formed to hold significant cash, assets or investments may not be considered a trading company

![]() Where the transferor has an interest of 5% or more in the company in the 12 months before the transfer, there is an additional requirement that the transferor must not exceed two fifths (2/5) of the total workforce. For this calculation you would consider any relative of the transferors as well.

Where the transferor has an interest of 5% or more in the company in the 12 months before the transfer, there is an additional requirement that the transferor must not exceed two fifths (2/5) of the total workforce. For this calculation you would consider any relative of the transferors as well.

![]() Maximum limit for income tax relief is £ 3600.00 per employee in the EOT. National insurance contributions would be made as usual

Maximum limit for income tax relief is £ 3600.00 per employee in the EOT. National insurance contributions would be made as usual

EOT’s are a popular mechanism where leadership succession can be implemented over time. As a retiring owner, you can be paid market value for your shares with no capital gain taxes. Employee ownership can be implemented at a pace that suits you. It also builds a clear shared purpose and collaborative way of working. Employees who are owners are more engaged and committed- income tax free bonuses are a good incentive to look forward to.